All Categories

Featured

Table of Contents

This policy design is for the customer who requires life insurance policy yet wish to have the ability to select just how their money value is spent. Variable plans are underwritten by National Life and distributed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Policy Firm, One National Life Drive, Montpelier, Vermont 05604.

The insurance firm will certainly pay out the face quantity straight to you and end your policy. Contrastingly, with IUL policies, your survivor benefit can enhance as your cash value expands, resulting in a possibly greater payment for your recipients.

Find out about the lots of advantages of indexed global insurance and if this sort of policy is appropriate for you in this helpful post from Protective. Today, numerous individuals are checking out the value of long-term life insurance policy with its capability to give long-lasting protection in addition to cash worth. indexed global life (IUL) has actually become a preferred option in giving irreversible life insurance protection, and an also better capacity for growth through indexing of passion credits.

How much does Flexible Premium Iul cost?

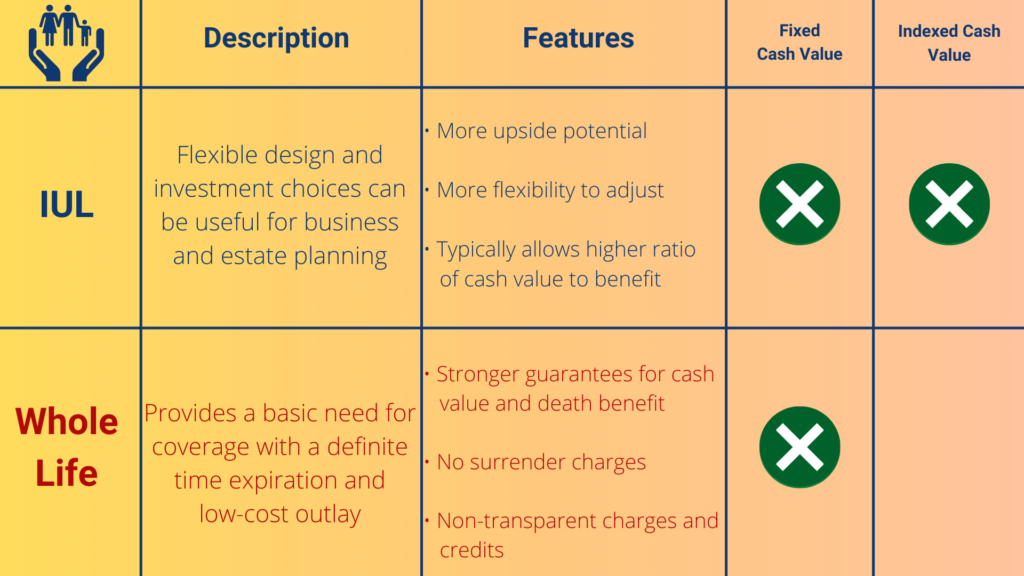

However, what makes IUL various is the means rate of interest is credited to your policy. Along with supplying a conventional declared rate of interest price, IUL provides the chance to make interest, based on caps and floorings, that is linked to the efficiency of a picked option of market indices such as the S&P 500, Dow Jones Industrial Average or the Nasdaq-100.

With IUL, the insurance policy holder picks the amount alloted amongst the indexed account and the fixed account. Similar to a normal universal life insurance policy plan (UL), IUL permits for a versatile costs. This indicates you can select to contribute more to your policy (within federal tax law limitations) in order to help you accumulate your cash worth even quicker.

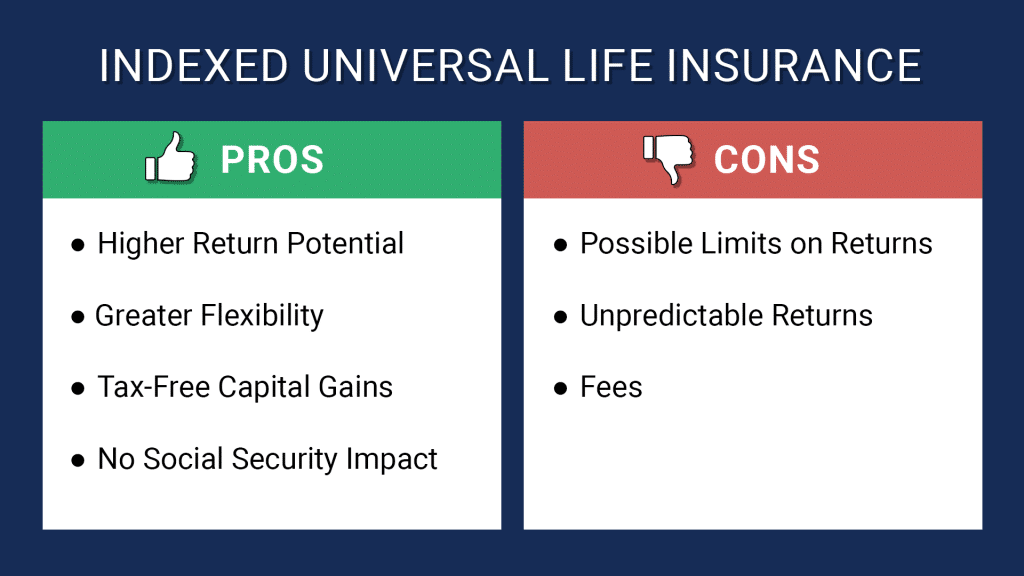

As insurance coverage plans with investment-like functions, IUL plans bill compensations and charges. While IUL plans likewise use ensured minimal returns (which might be 0%), they likewise cap returns, also if your pick index overperforms.

Created by Clifford PendellThe advantages and disadvantages of indexed universal life insurance policy (IUL) can be difficult to understand, particularly if you are not accustomed to exactly how life insurance works. While IUL is just one of the most popular items on the market, it's additionally among the most volatile. This sort of coverage could be a viable choice for some, however, for the majority of people, there are better options avaiable.

How can I secure High Cash Value Iul quickly?

Additionally, Investopedia lists tax advantages in their advantages of IUL, as the death benefit (money paid to your recipients after you die) is tax-free. This is true, yet we will include that it is additionally the instance in any life insurance plan, not just IUL.

The one thing you need to understand concerning indexed universal life insurance is that there is a market danger involved. Spending with life insurance is a various video game than purchasing life insurance coverage to safeguard your family members, and one that's not for the faint of heart.

All UL products and any kind of general account item that depends on the performance of insurance companies' bond portfolios will certainly be subject to interest price danger."They continue:"There are fundamental dangers with leading clients to think they'll have high prices of return on this item. A customer might slack off on funding the cash worth, and if the plan does not execute as expected, this could lead to a lapse in protection.

In 2014, the State of New York's insurance regulator probed 134 insurance firms on how they market such policies out of worry that they were exaggerating the possible gains to customers. After proceeded examination, IUL was struck in 2015 with regulations that the Wall surface Road Journal called, "A Dose of Fact for a Hot-Selling Insurance Item." And in 2020, Forbes published and short article entitled, "Sounding the Alarm on Indexed Universal Life Insurance Coverage."Regardless of hundreds of write-ups alerting consumers about these policies, IULs remain to be among the top-selling froms of life insurance policy in the USA.

Indexed Universal Life Retirement Planning

Can you handle seeing the stock index carry out badly knowing that it directly influences your life insurance policy and your ability to shield your family? This is the last gut check that deters even extremely well-off capitalists from IUL. The entire point of purchasing life insurance is to decrease threat, not produce it.

Find out a lot more regarding term life below. If you are looking for a policy to last your whole life, take an appearance at ensured global life insurance policy (GUL). A GUL policy is not practically permanent life insurance policy, yet instead a hybrid in between term life and global life that can allow you to leave a heritage behind, tax-free.

Your cost of insurance coverage will certainly not change, also as you get older or if your health adjustments. You pay for the life insurance coverage security just, simply like term life insurance.

What is included in Iul Insurance coverage?

Guaranteed global life insurance policy is a portion of the cost of non-guaranteed universal life. You don't risk of losing insurance coverage from negative investments or changes in the market. For an extensive contrast in between non-guaranteed and guaranteed universal life insurance policy, visit this site. JRC Insurance Coverage Group is right here to aid you locate the ideal policy for your requirements, without any added expense or cost for our support.

We can fetch quotes from over 63 premier service providers, enabling you to look beyond the big-box firms that usually overcharge. Consider us a pal in the insurance policy sector who will look out for your finest interests.

Where can I find Iul Investment?

He has actually helped thousands of family members of businesses with their life insurance policy needs given that 2012 and specializes with applicants that are less than excellent health and wellness. In his extra time he enjoys spending quality time with family, traveling, and the excellent outdoors.

Indexed global life insurance coverage can aid cover numerous monetary requirements. It is just one of numerous kinds of life insurance readily available. As you undergo your insurance choices, you may be unsure of what could be ideal for your demands and circumstance. Indexed global life insurance is a form of universal life insurance policy.

Latest Posts

Disadvantages Of Indexed Universal Life Insurance

Equity Indexed Universal Life

Iul Training